Embarking on an investment journey can be an exhilarating but daunting endeavor, particularly for those starting with a modest capital. The vast sea of investment opportunities might appear overwhelming, yet even with limited funds, the world of investing is more accessible than ever. This essay delves into the intricacies of various investment vehicles, from the soaring potential of stocks to the relative stability of bonds, along with the diversified realms of mutual funds and ETFs. By familiarizing yourself with these instruments, you can navigate through the financial currents with more confidence, ensuring that your investment decisions are both judicious and congruent with your fiscal landscape and personal appetite for risk.

Understanding Different Investment Options

Kickstarting Your Investment Journey: Options for the Budget-Savvy Beginner

In the teeming world of business and finance, where savvy investors thrive by casting nets wide and knowledge deep, there exists an eclectic array of opportunities for the enterprising beginner with an eye toward growth. Despite the common misconception, you need not a vault of riches to commence your investment voyage. Here’s how you can dip a toe in the fiscal waters without sinking your ship.

Firstly, one cannot overlook the power of the Stock Market. Start with a focus on fractional shares, the unsung heroes for the financially constrained investor. Companies such as Vested, M1 Finance and Robinhood offer the chance to invest in small, affordable pieces of stock. It means participating in the fortunes of industry titans is no longer exclusive to the deep-pocketed.

Mutual Funds present another inviting avenue. With the ability for diversification and professional management, they can be the cornerstone for a fledgling portfolio. Begin with low-cost index funds, which mirror the performance of a market index and require a minimal investment. It’s a solid play for those seeking to marry affordability with a long-term viewpoint.

High-Yield Savings Accounts are for those who prioritize security and accessibility. While not as glamorous as other investments, these accounts offer higher interest rates over traditional savings accounts and are ideal for stashing away funds and earning a return with virtually no risk. Ally Bank and Marcus by Goldman Sachs rank high for their competitive rates.

Then, there’s the burgeoning realm of Robo-Advisors – a matchmaker for the modern investor and diversified portfolios. Platforms like Betterment and Wealthfront craft investment strategies tailored to risk tolerance and financial goals, all while requiring modest initial investments. They represent the quintessence of leveraging technology for financial empowerment.

Don’t shirk from the world of Exchange-Traded Funds (ETFs), either. Offering diversification and low expense ratios, they are traded much like stocks and allow for manoeuvring within the market without the need to invest heavily in individual stocks. For a beginner with the spirit of a hawk, ETFs offer the prospect of portfolio growth without the eagle’s nest egg.

Real Estate Investment Trusts (REITs) provide a way to venture into real estate without having to buy property outright. A REIT invests in real estate and pays out dividends from its income. With platforms such as Fundrise or RealtyMogul, even the most frugal investor can reap passive real estate dividends.

Finally, let us not dismiss the zeal of Peer-to-Peer Lending, otherwise known as P2P. Platforms like Prosper and LendingClub allow investors to provide loans to individuals or businesses online and earn interest on the repayments. It’s a fresh terrain, mingling the excitement of entrepreneurship with the steadiness of income.

Embarking on an investment journey need not be daunting. Beginners with limited funds have plentiful options that accommodate both their financial parameters and their appetite for risk and reward. Smart, strategic, and informed moves in the investment landscape are not reserved solely for the financial goliaths. Even the modest investor can carve a niche in this expansive ecosystem of opportunity. As with any enterprise, the tenets of research, remaining abreast with trends, and networking can expand not only your portfolio but also your horizon.

Setting Up an Investment Account

In the quest to amplify those hard-earned dollars through savvy investing strategies, it’s crucial to further explore avenues that cater to small initial investments. Diving deeper, one finds fertile grounds in the realms of micro-investing apps and the burgeoning domain of cryptocurrency.

Micro-investing apps have democratized the investment landscape, flinging the doors wide open for those with modest sums. The strategy? Rounding up everyday purchases to the nearest dollar and investing the change. Imagine buying a latte and inadvertently setting aside fifty cents towards an investment portfolio – the beauty of micro-investing is in its simplicity and accessibility. By selecting the right app, one can build a diverse portfolio without feeling the immediate financial strain. It’s the tortoise approach in a hare-dominated world, steady, sure, and certainly smart.

The cryptocurrency market, while relatively nascent and certainly volatile, has also pitched its tent in the territory of small-scale investors. With the option to purchase fractions of high-value digital currencies like Bitcoin, the cryptocurrency exchanges present a frontier for those willing to navigate the digital market’s ebbs and flows. Innovative platforms enable investors to start small, learning the ropes while potentially gaining from the market’s wild swings.

To unlock these opportunities, one must distill the mechanics into actionable steps:

- Micro-Investing Apps

- Conduct diligent research to identify tried-and-true apps with a solid track record.

- Assess fee structures; opt for platforms with transparent, minimal fees to maximize returns.

- Set an account with a simple sign-up process – a matter of minutes with basic personal and financial details.

- Link a primary spending account whereby transactions are rounded up for investment purposes.

- Cryptocurrency Investments

- Familiarize with the technology and inherent risks; knowledge is indeed power in this novel market.

- Choose a reputable exchange platform that values user security and has an intuitive interface.

- Create an account, which includes setting up two-factor authentication for strengthened security measures.

- Start by purchasing fractional coins; consider dollar-cost averaging to mitigate risks associated with volatility.

Remember, diversification remains the golden rule of investment strategy. The ability to spread investments across multiple platforms and asset classes is a formidable shield against the slings and arrows of outrageous fortune – or market fluctuations, less dramatically put. By leveraging these supplementary channels, investors can fortify their financial footing with a calculated approach to risk and reward.

In conclusion, the expansion of accessible investing platforms has empowered the everyday entrepreneur to start with modest investments. Embrace these tools, build a diverse portfolio incrementally, and remain agile, staying abreast of market advancements. The art of the start is chiseling away the barriers to entry, and there’s no time like the present to get in on the ground floor.

Learning the Basics of Dollar-Cost Averaging

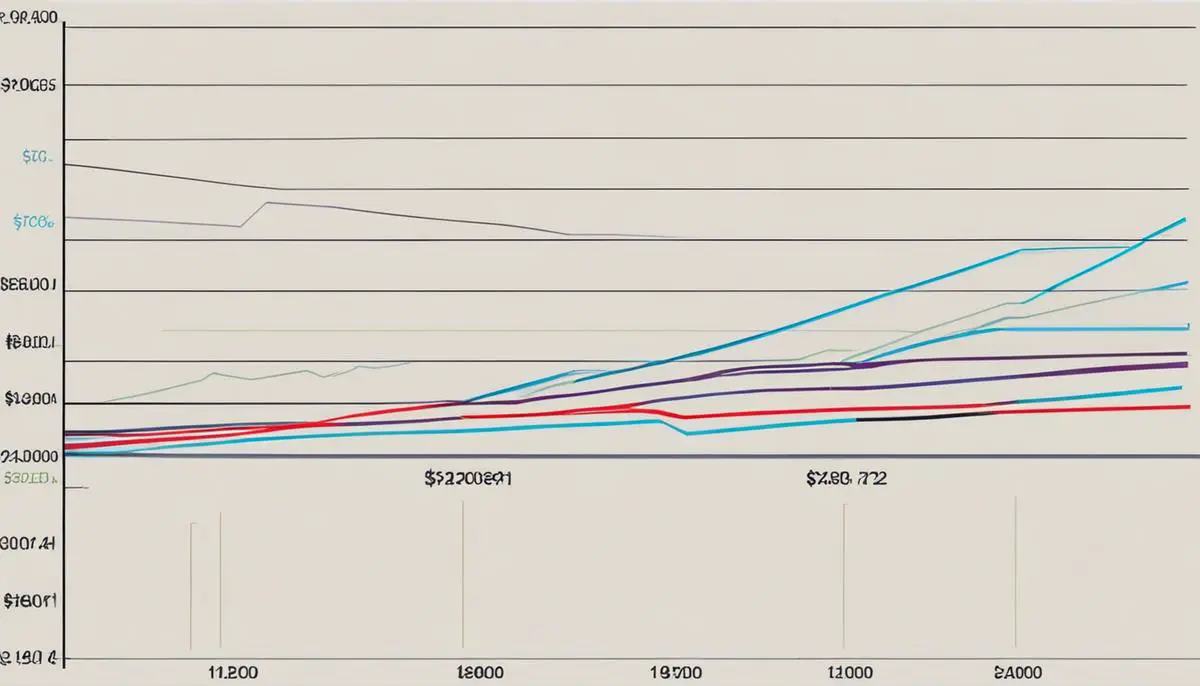

When considering the financial growth landscape, a strategy as robust as dollar-cost averaging (DCA) cannot be overstressed for investors operating with a more modest capital infrastructure. The genius behind dollar-cost averaging lies in its simplicity and accessibility, enabling those at diverse economic starting points to take part in investment endeavors with calculated exposure to market volatility.

For the uninitiated, dollar-cost averaging is the practice of consistently investing a fixed amount of money into a particular investment or portfolio over time, no matter the market condition. This systematic investment approach is particularly strategic for the following reasons:

- Price Averaging Over Time – With DCA, rather than trying to time the market, an investor buys more shares when prices are low and fewer shares when prices are high. Over time, the average cost per share can potentially lower, mitigating the risk of investing a large amount in a single transaction at an inopportune time.

- Reducing Psychological Barriers – The emotional rollercoaster of the investing world can be daunting. DCA helps mute the intimidating peaks and troughs of market fluctuations, providing a disciplined, emotion-free strategy. This is pivotal for investors who might otherwise hesitate to invest during market downturns or overcommit during booms.

- Flexibility and Discipline – Investors who utilize dollar-cost averaging commit to a strategy that naturally instills financial discipline while maintaining flexibility. Regular contributions to investment accounts encourage a long-term approach, promoting stability and growth through market cycles.

- Accessibility to All Market Players – Regardless of market turbulence, investors who stick with their DCA strategy won’t need significant capital to start. This is particularly advantageous during times of economic uncertainty when large lump-sum investments could be more susceptible to market downturns.

- Mitigation of Timing Risk – Predicting the best entry point and attempting to ‘beat the market’ is a perilous game, even for the most seasoned investors. By adhering to dollar-cost averaging, the need to forecast market movements is removed, inherently reducing timing risk.

Perfectly marrying with technologies like robo-advisors and micro-investment platforms, DCA becomes an even more potent tool. Together, they unlock the potential for individuals to optimize their investments for long-term gains without overcommitting financial resources at any given point.

In a world of entrepreneurial vigor and the democratization of finance, dollar-cost averaging stands as an invaluable strategy for investors aiming to build wealth steadily. As the landscape of investment continues to democratize, tools such as DCA ensure that every investor, no matter the scale of their capital, can participate in the journey towards financial growth and stability. Embracing dollar-cost averaging is more than a mere investment strategy; it’s a commitment to methodical growth, financial empowerment, and an expression of resilience in the ever-shifting tides of economic fortune.

As we’ve unraveled the tapestry of investment strategies for the financially prudent individual, it’s clear that commencing an investment portfolio doesn’t necessitate a fortune. Through the measured approach of dollar-cost averaging, the strategic choice of a suitable investment account, and an informed grasp on the array of options available, you are now equipped to take those initial, decisive steps toward securing your financial future. By the careful implementation of the principles and tactics explored, the prospect of building wealth incrementally is not only viable but well within reach, setting a cornerstone for enduring financial health.